Optionator app for iPhone and iPad

Description of the Optionator

Calculate the value of a range of stock options.

Currently implemented options:

European/American Call/Put

European Forward Start Call/Put

European One-Cliquet

European Knock-in/out Barrier Call/Put

European Forward Start Knock-in/out Barrier Call/Put

European/American Cash or Nothing Call/Put

European/American Assett or Nothing Call/Put

European Floating/Fixed Strike Look-Back Call/Put

more to come in the future ...

up to three different methods (depending on the type of option) are available to calculate option:

analytic (exact), binomial tree (bn), monte carlo (mc)

you can influence the accuracy of the binomial tree and monte carlo method by choosing the number of time steps (bn,mc) and number of sampled paths (mc) - larger numbers yield more accurate results and take longer time to calculate.

calculate either option price or determine implied volatility for given price

input values are:

asset value,strike price,expiry (days),risk-free interest rate (% per year), volatility (% over a year) or option price, barrier (for barrier options), forward-start time (days), cash (cash options), rebate (knock in/out options), dividend (% per year, currently only continuous, specific dates to come).

output:

option price or volatility, Delta, Gamma, Vega, Theta, Rho, time value, elasticity

the app features a simple catastrophe estimator (black friday):

set the probability of a crash (within a year) and the amount of stock value decrease (%) during the crash. The option price reflects the effect. Note that this is only a rough estimate and works reasonably well for european options without fixed-time events (like forward start dates) during the life time of the option.

-------------------

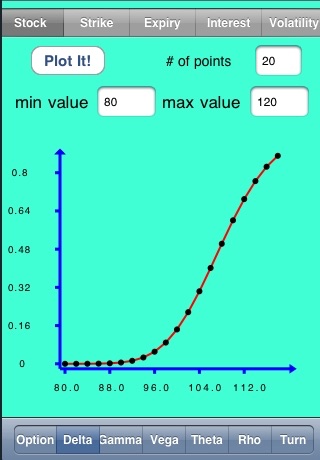

switch to the plotting view by tapping on "turn" in the lower.right corner (return to the previous view by pressing "turn" again).

you can generate 2d plots of the results using the following choices:

set the quantitiy for the horizontal (x) axis

choices are stock value, strike price, expiry, interest rate, volatility

set the quantity for the vertical (y) axis

choices are option price, Delta, Gamma, Vega, Theta, Rho

set the range of x values and the number of plotting points

in case of monte carlo calculations error bars are displayed, which you can reduce by increasing the accuracy parameters discussed above.

3d plots to come in future releases.

---------------------

There is NO guarantee for the correctness of any of the results calculated by this application.

Enjoy!